can you go to jail for not doing taxes

Any action you take to evade an assessment of tax can get one to five years in prison. In general no you cannot go to jail for owing the IRS.

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

Beware this can happen to you.

. Can you go to jail for doing taxes wrong. In short yes you can go to jail for failing your taxes. HMRC estimates that 93 of tax due is paid and this is largely due.

You can only end up in jail for tax law violations if criminal charges are filed against you and you are prosecuted and sentenced in a criminal trial before the court. Oftentimes youll be subject to tax penalties which will run you a pretty penny at up to 50 of your unpaid tax amount. The short answer is maybe.

In fact according to 2018 data 14. Although it is very unlikely for an individual to receive a jail sentence for. If you dont file youll face a failure-to-file penalty.

The penalty is 5 percent of your unpaid taxes for each month your tax return is late up to 25 percent. It is possible to go to jail for not paying taxes. With this in mind you should also remember that the statute of limitations for tax evasion and.

It depends on the situation. Unpaid taxes arent great from the IRSs perspective. To put it as simply as possible you can be arrested for not paying your taxes not a jail term.

In fact even an audit is highly unlikely to land you in jail. Below are some examples of potential. Generally speaking tax evasion is not a common problem.

In general no you cannot go to jail for owing the IRS. Your actions must be willful and. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

You may even face wage garnishment or property seizure. Back taxes are a surprisingly common occurrence. But you cant be sent to jail if you dont have enough money to pay.

When it is clear that you owe the IRS you may not be sent to jail but the IRS may take one of the following actions depending on the nature and reason behind your failure to pay the taxes. Not being able to pay your tax bill Unpaid taxes arent great from the IRSs perspective. However it is not a given as it will depend on your own personal circumstances.

How much do you have to owe IRS to go to jail. However if your taxes are wrong by design and you intentionally leave. However failing to pay your taxes doesnt automatically warrant a jail sentence.

The short answer is yes. So can you go to jail for not filing taxes in the US. To make the answer as simple as possible you can get arrested for not filing your taxes.

In fact you could be jailed up to one year for each year that you fail to file a federal tax return. The question can you go to jail for not filing taxes is complicated and multifaceted. Back taxes are a surprisingly common occurrence.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. Yes you can be sent to prison for not paying tax. However your actions must be willful and intentional which means you will not be.

But you cant be sent to jail if you. You cannot go to jail for making a mistake or filing your tax return incorrectly. If you owe more than you can afford the IRS will work out.

In fact according to 2018 data 14. If you are found guilty of income tax evasion via fraud whether or not you go to jail will depend on the type of fraud involved. And you can get one year in prison for each year you dont file a return.

Police will not be kicking. Plus if you file more than 60 days late. Regardless it is incredibly important that you.

How much do you have to owe IRS to go to jail.

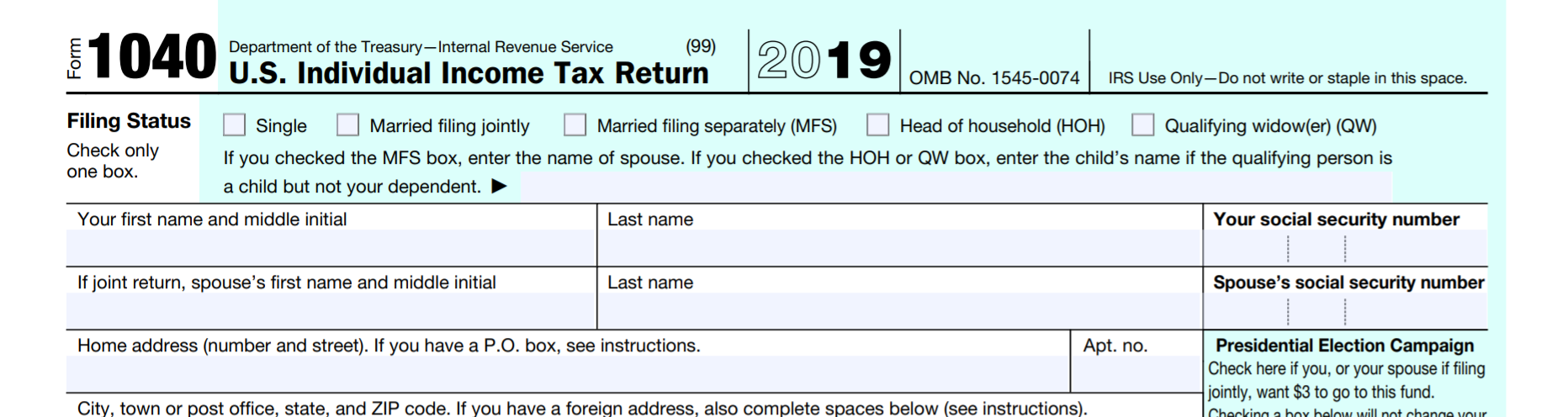

Preparing Tax Returns For Inmates The Cpa Journal

Can You Go To Jail For Not Paying Credit Cards Debt Com

Here S What Happens When You Don T File Taxes

Wesley Snipes Who Was Jailed For Failure To File Taxes Claims Trump Avoided Tax Because Of Who He Knows The Independent

What To Do If Your Tax Refund Is Wrong

Can You Go To Prison For Not Paying Or Not Filing Your Taxes

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Can A Debt Collector Have Me Arrested Debt Com

Preparing Tax Returns For Inmates The Cpa Journal

Can You Go To Jail For Not Filing A Tax Return Damiens Law Firm

What To Do If You Made A Mistake On Your Taxes Time

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

Findlaw Com What Happens If You Don T Pay Your Taxes Know What Actions Can Land You In Jail Findlawconsumer Https Tax Findlaw Com Tax Problems Audits Can You Go To Jail For Not Paying Taxes Html Dcmp Fbc Osocial Z 2019november Facebook

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Can You Go To Jail For Not Paying Your Taxes Paladini Law

Stream Episode Can You Go To Jail For Not Paying Taxes By All Tax Expert Podcast Listen Online For Free On Soundcloud

What Happens If You Don T File Taxes For 10 Years Or More Findlaw